Last night we attended the Deakin University, Richard Searby Oration, delivered by Dr Guy Debelle, Assistant Governor (Financial Markets), Reserve Bank of Australia. His topic was: Credo et Fido: Credit and Trust.

The 2012 Oration explored the importance of credit and trust within the financial system and how the breakdown in trust post 2007 and the Global Financial Crisis (GFC) is severely hampering the global recovery.

Debelle’s hypothesis is that there is no credit without trust because there is always asymmetrical information in a loan transaction, the borrower always knows more about his/her/its financial situation and intentions than the lender and trust is needed to bridge this knowledge gap and allow the loan to be made.

This is as true of a depositor lending to a financial institution as it is of a bank lending to a borrower or importantly one financial institution lending to another institution. When trust breaks down, the lending process slows up or stops altogether. For more on the value of trust see: WP1030_The_Value_of_Trust

However, trust implies risk, the root cause of the GFC was overconfidence, leading to lax lending practices, supported by a lack of effective due diligence, leading to a chronic underpricing of risk. This allowed highly unethical, if not criminal practices to develop exponentially with institutions offloading risk to other institutions at a fraction of the real price. This complacency and ‘lazy trust’ allowed vast ‘bubbles’ of underpriced risk to develop across the whole financial sector. When the finance system was eventually forced to take a severe look at its situation, trust evaporated, credit dried up and the GFC destroyed value around the world.

The sovereign states (ie, governments) as lenders of last resort were in many cases unable to counterbalance the situation because trust in their ability to repay debt also evaporated. Pricing risk requires a reasonable degree of confidence that the parameters of the ‘unknown’ are knowable and a reasonable probability can be assigned to a defined risk exposure. Post GFC the breakdown of trust and confidence in financial markets has lead to uncertainty. When lenders ‘don’t know’ what the risk is they cannot price the risk, set a reasonable premium and use the information to strike a loan rate. If lender cannot set an interest rate for a loan, there is no loan (or the rates are exorbitantly high and the loan periods very short).

On-going banking scandals in Europe and the USA are continuing to erode trust and slow the rebuilding, despite money supply being expanded by the central banks. Having money is no good if you cannot trust anyone to lend it to.

The thread of argument that can be drawn from the above is that access to the credit needed to fund economic growth is based on a large proportion of a society having enough confidence in their financial systems for a reasonable degree of pragmatic trust to be extended by lenders to borrowers (and the borrowers having sufficient confidence in the situation and system to seek loans). This is as much a function of the underlying emotional settings within a society as the actual facts of the situation.

Australia is an interesting example. The GFC had minimal overall effect on the economy due to much tighter fiscal and banking policies, supported by swift government action. The current situation is also good with relatively low debt and the Reserve Bank has significant options open to keep the economy growing.

The overall strength of the economy was outlined in a speech entitled ‘The Glass Half Full’ given by Glenn Stevens’, Governor of the Reserve Bank of Australia (RBA), in his address to the American Chamber of Commerce (SA) AMCHAM Internode Business Lunch held in Adelaide on the 8 June 2012 (see: http://www.rba.gov.au/speeches/2012/sp-gov-080612.html).

One of the key charts presented by Stevens shows the inflation adjusted per capita GDP in Australia has hardly missed a beat – the GFC had a flattening effect but overall business conditions for the last 5 years have remained basically the same and are improving.

GDP = Gross Domestic Product and is directly correlated to the spending power per person (compounded by the growth in the Australian population). The only significant change highlighted in Steven’s report was a shift from an unsustainable growth in personal borrowings back towards a more sustainable savings rate which under any normal circumstance would be seen as good economic sense, particularly given the disasters in places like Ireland, Spain and Iceland caused by excessive borrowing.

So given the basically solid performance of the Australian economy, one would expect a similar trend in business confidence?? Unfortunately this is not the case:

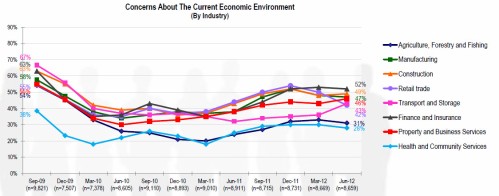

A survey of business confidence by DBM Consultants shows confidence crashed in the period between 2007 and 2009 and continues to ‘flat-line’ with the vast majority of businesses being concerned about the economy. This flows through into low expectations for increasing employment and taking on borrowings (see: www.dbmconsultants.com.au).

The question is why is there such as big disconnect between the financial facts as presented by the RBA and the emotional distrust expressed by business in the DBM report?

My feeling is the key driver is the almost unrelenting stream of negative reporting in the press focusing on ‘bad news’ stories such as plant closures rather than good news stories such as the overall growth in employment (even in the manufacturing states such as Victoria), supported by a similar campaign by the federal opposition for short term political gain. This combination of unrelenting negativity will undoubtedly lower the level of optimism in the community (shown by numerous surveys) and lower the levels of trust in the government which as the ‘lender of last resort’ flows through into the financial and business communities.

Given the press appear to believe bad news sells papers and the opposition has a vested interest in winning the next election, both legitimate objectives, one wonders what needs to happen to start the shift in confidence highlighted as essential in Dr Debelle’s oration? The belief highlighted in the DBM report above has to be having a direct effect on the rate of growth in the economy because businesses are not investing, not training staff and not employing at the levels they could if there was more confidence – to an extent, the emotions are self-fulfilling.

As individuals we cannot do much at a national or international level, but we can learn from the wider world. When dealing with your team and/or communicating with stakeholders a proper balance is needed between achievements and issues. Focusing only on bad news and you will damage future prospects – unrelenting negativity is likely to be self-fulfilling; whilst unfounded optimism is a recipe for disaster if you ignore prudent good practice.